ABANDONMENT – A relinquishing of property by the owner to the insured in order to claim a total loss when, in fact, the loss may be less than total. This is not permitted under the terms of the fire insurance policy (See SALVAGE) but, under proper circumstances, the principle is applicable in ocean marine business.

ABOVE–NORMAL LOSS (ANL) – A loss made greater than normal by conditions such as weather, delayed alarm, etc.

ABSOLUTE LIABILITY – Liability without fault. (See also STRICT LIABILITY)

ACCIDENT – An unexpected, unforeseen, unintended event or incident resulting in personal injury or property damage. (See also OCCURRENCE)

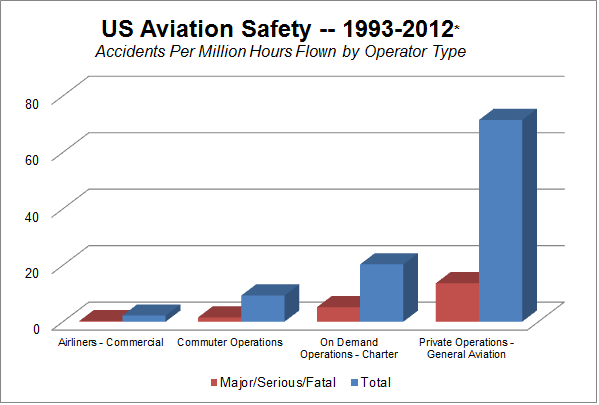

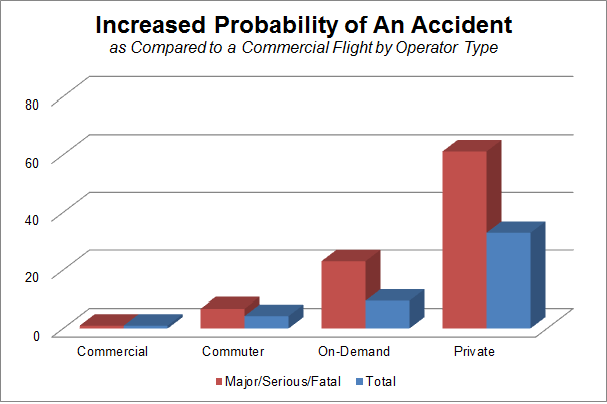

ACCIDENT (AVIATION) – Defined by the FAA as an occurrence associated with the operation of an aircraft in which any person suffers death or serious injury, or in which the aircraft receives substantial damage.

ACCIDENT FREQUENCY RATE – Rate of occurrence of accidents; e.g., number of accidents per million man–hours worked.

ACCIDENT SEVERITY RATE – A measurement of the seriousness of the results of accidents; e.g., days lost per one thousand man–hours worked.

ACCIDENTAL MEANS – The external and violent occurrences that cause the accident.

ACT OF GOD – An accident or event that is the result of the forces of nature, without human intervention, and one that could not have been prevented by reasonable foresight or care; e.g., flood, lightning, earthquake, hurricane. (See also FORCE MAJEURE)

ACTUAL CASH VALUE (ACV) – Usually the cost to replace destroyed property to its condition immediately preceding a loss, taking into consideration depreciation based on age, condition, time in use and obsolescence. Other factors such as the nature of the property and the market value of the property may be involved in determining the actual cash value of an individual loss.

ACTUARY – An individual, often holding a professional degree, who makes statistical computations to determine insurance rates.

ADDITIONAL INSURED – A person or entity other than the named insured, who is protected by the policy, often in regard to a specific interest.

ADDITIONAL INTEREST – The interest of an additional insured.

ADJACENT – One building is adjacent to another if it is very close to, but not touching, the other building.

ADJOINING – A building is adjoining when it is so located that it touches another building.

ADJUSTER – One who negotiates the settlement of claims for an insurance carrier.

ADJUSTMENT BUREAU – An organization created for the adjusting of losses. These organizations are generally used by companies not employing staff adjusters.

ADMIRALTY LAW – A system of jurisprudence pertaining to navigation of public waters. Analogous to Maritime Law.

ADMITTED COMPANY – An insurance company licensed by the state or country to do business in that state or country. Many countries require local risks to be insured by local or admitted insurers.

ADVERSE SELECTION – A situation where underwriters find they have written the less desirable risks of a certain category.

AGENT – (See also INSURANCE AGENT)

AGGREGATE LIMIT – Limit of liability of the insurer for the total amount of all claims during the policy period.

AGREED AMOUNT CLAUSE – A provision that protects the insured from being penalized by the insurer for being underinsured in case of loss. In effect, it neutralized the coinsurance, average, or contribution clause. It is particularly desirable for unusual properties or in times of inflation.

AIRCRAFT HULL INSURANCE – Insurance covering the value of the aircraft.

AIRCRAFT LIABILITY INSURANCE – Insurance covering liabilities arising out of use and ownership of aircraft, excluding passenger liability.

AIRPORT LIABILITY INSURANCE – Insurance covering liabilities arising out of the operation of an airport.

ALIEN COMPANY – An insurance company domiciled outside the United States, whether licensed in the state or not. (See also DOMESTIC COMPANY and FOREIGN COMPANY)

ALL RISK INSURANCE – Insurance that protects against all risks except those specifically excluded. In an all-risk policy the burden of proof that the peril causing the loss was excluded falls to the insurer. In a named peril policy the burden of proof that damage was caused by an insured peril falls to the insured.

AMBIGUOUS – Unclear, open to different interpretations. Ambiguities in an insurance contract are usually construed by the courts against the writer.

AMOUNT SUBJECT – The value that may reasonably be expected to be lost in a single fire or other casualty.

ANNUALIZATION – A provision that allows the insurer to adjust the annual premium of policies issued for more than one year to the rate prevailing at each anniversary date.

ANNUITY – A specified sum payable at certain regular intervals during the lifetime of one or more persons, or payable for just a specific period.

APPLICATION – A written statement, frequently in the form of a questionnaire, by a prospective policyholder providing information on which the insurer relies. Misrepresentation will void most policies. In London it is called a proposal.

APPORTIONMENT CLAUSE – Where more than one insurance contract covers a loss, the determination of the extent to which each contract covers. The division of a loss for which insurers may be liable under two or more contracts to determine the liability under each contract.

APPRAISAL – Determination of the value of property, or of the extent of damage, usually by impartial experts.

APPRAISER – One whose function is to determine the value of goods, property, etc.; a determination of the value of property, made by impartial experts.

APPRECIATION – Increase or rise in value or price.

APPROVED – A term used to describe adherence to a standard to indicate that the object meets requirements for insurance or for a reduced premium rate; e.g., approved roof or approved cargo.

ARBITRATION – Referral of a dispute to disinterested but knowledgeable parties whose decision may be binding on the parties to the dispute; e.g., value of a claim.

ARSON – The willful and malicious burning of property, sometimes with the intent of defrauding the insurance companies.

ASSAULT – Threat to inflict injury. It mayor may not include battery (actual bodily injury).

ASSESSABLE INSURANCE – A policy which provides for the insurer to charge its policyholders additional premium to cover their proportionate share of losses of the Insurer.

ASSIGNED RISK – A risk that is assigned, by state law, to an insurer from a pool of insurers (usually, all those licensed in the state) who would not otherwise accept the risk.

ASSIGNMENT – The transfer of one's interest in an insurance contract to another; in many kinds of insurance, valid only with the consent of the insurer; in life insurance, usually binding on the insurer only if filed with the insurer; the transfer, after an event insured against, of one's right to collect an amount payable under an insurance contract.

ASSURANCE – Insurance.

ASSURED – One who is protected against loss under an insurance policy. (Insured or Policyholder).

ATTRACTIVE NUISANCE – Conditions of a property which tend to attract children; e.g., sand pile or structures that can be climbed. Owners of such property have the legal duty of taking unusual care to protect children, even though they illegally trespass on the property.

AUDITABLE POLICY – Policy that allows for an examination of the insured's records, transactions, and assets to determine the premium due to the carrier for certain kinds of insurance. Audits are conducted in areas for which the premium is based; e.g., payroll, gross receipts, values on hand, owned vehicles, etc.

AUTOMATIC COVERAGE – Subject to contract terms, coverage of additional property or other risk by an existing contract without specific request by the insured.

AUTOMOBILE INSURANCE – Insurance against loss to the insured due to damage to or destruction of automobiles, or due to claims for damages arising from the ownership, maintenance, or use of automobiles; also, loss to persons insured in certain specific ways due to cost of medical, surgical, or hospital care necessitated by automobile accidents. Coverages include collision, comprehensive, liability and medical.

AVERAGE – A term used in ocean marine insurance to mean loss or damage.

AVERAGE CLAUSE – A clause providing that the insurer shall be liable in event of loss for not more than that proportion of the loss that the amount of insurance under the policy bears to a specified percentage of the actual cash value of the property insured. (See also COINSURANCE CLAUSE)

AVERAGE RATE – Where several separate risks are insured under a single policy for a single amount of insurance, the rate determined by taking the weighted average of the rates for the various risks insured separately.

AVIATION INSURANCE – A classification of insurance relating to hazards associated with aviation. Coverages include aircraft liability, aircraft hull, passenger liability, airport liability, hangerkeepers' legal liability and nonowned aircraft liability.

AVIATION CLAUSE – A clause limiting the liability of the insurer in the case death or injury is connected in a specified degree with aviation.

Copyright © 2024 The President and Fellows of Harvard College | Accessibility | Digital Accessibility | Report Copyright Infringement